Summary:

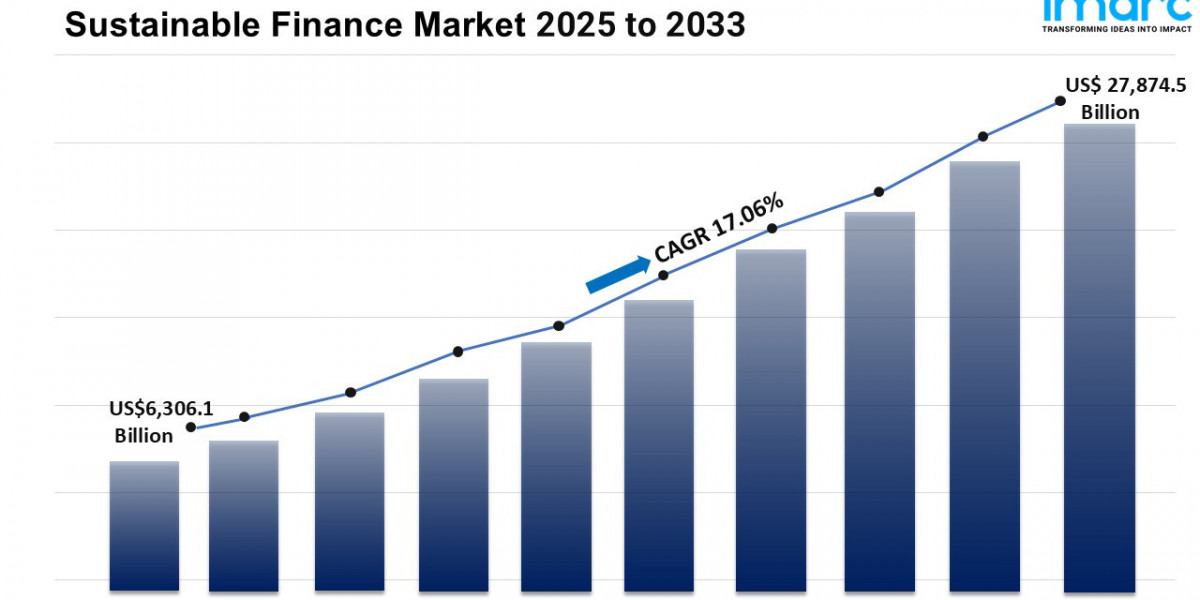

- The global sustainable finance market size reached USD 6,306.1 Billion in 2024.

- The market is expected to reach USD 27,874.5 Billion by 2033, exhibiting a growth rate (CAGR) of 17.06% during 2025-2033.

- North America leads the market, accounting for the largest sustainable finance market share.

- Based on the investment type, the market has been categorized into equity, fixed income, and mixed allocation.

- Green bond holds the largest share in the sustainable finance industry.

- Utilities remain a dominant segment in the market due to their essential role in energy transition.

- Increasing knowledge about environmental, social, and governance issues is a primary driver of the sustainable finance market.

- Supportive government policies and increasing interest in eco-friendly investments are reshaping the sustainable finance market.

Industry Trends and Drivers:

Growing Demand for Green Bonds and Sustainable Investment Products:

The sustainable finance market is witnessing a significant surge in demand for green bonds, ESG (Environmental, Social, and Governance) investments, and other sustainable investment products. This trend is largely driven by the increasing awareness among investors about climate change, environmental degradation, and the need to promote responsible business practices. By 2025, the green bond market is expected to reach new heights as corporations and governments seek to finance eco-friendly projects that align with global sustainability goals. Financial institutions are ramping up their offerings of ESG-themed investment products, driven by the desire to not only offer higher returns but also contribute to positive social and environmental impact. As a result, institutional investors, high-net-worth individuals, and even retail investors are shifting their capital to sustainable assets, increasing their focus on companies that integrate environmental responsibility and social justice into their business models. Financial regulators are also responding with tighter standards and reporting guidelines, pushing businesses to disclose ESG-related risks and opportunities, thus fueling further growth in the market. By 2025, demand for green and sustainable finance solutions is expected to be fully mainstream, creating opportunities for companies and financial services providers to align their portfolios with the growing demand for ethical investments.

Technological Innovations Driving Sustainability in Finance:

Technological advancements are reshaping the landscape of sustainable finance, with innovations in artificial intelligence (AI), blockchain, and data analytics playing a key role in transforming how financial products are designed, traded, and monitored. The rise of fintech platforms dedicated to ESG investments is making it easier for investors to access sustainable financial products, track their impact, and make data-driven decisions. By 2025, technologies like blockchain will ensure more transparent and accountable reporting of ESG performance, enabling companies to provide verifiable evidence of their sustainability claims. AI-powered tools are already being used to assess ESG risks, automate investment strategies, and monitor the long-term impact of sustainable investments. Additionally, digital platforms will allow for faster and more efficient transactions, providing cost-effective solutions for small and medium-sized enterprises (SMEs) to access sustainable finance. The adoption of these technologies by banks, asset managers, and insurance companies is expected to drive efficiency, improve risk management, and enhance market accessibility, ultimately contributing to the continued expansion of the sustainable finance market. As a result, technological innovations will be a critical enabler of the growth and mainstream adoption of sustainable finance solutions by 2025.

Regulatory Pressures and Policy Incentives Shaping Sustainable Finance:

Regulatory frameworks and government policies are expected to play a pivotal role in shaping the trajectory of the sustainable finance market by 2025. Governments across the globe are recognizing the importance of green and sustainable financial practices, and many are introducing stricter regulations and incentives to encourage businesses to adopt sustainable financial models. In Europe, for instance, the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR) are providing clear guidelines for classifying economic activities based on their environmental impact, which will push companies to integrate sustainability into their operations and financial disclosures. In parallel, policymakers in emerging markets are offering tax breaks, grants, and subsidies for businesses that implement sustainable practices, fostering the growth of green bonds, renewable energy investments, and climate-positive financing. By 2025, these regulations will not only drive more capital toward sustainability but also standardize ESG criteria across regions, improving the quality of reporting and accountability in the market. As sustainable finance becomes more integrated into national and international policies, it will gain legitimacy and acceptance, further accelerating its adoption across industries and financial sectors.

Request Sample For PDF Report: https://www.imarcgroup.com/sustainable-finance-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

Investment Type Insights:

- Equity

- Fixed Income

- Mixed Allocation

The market is divided into equity, fixed income, and mixed allocation based on investment type.

Transaction Type Insights:

- Green Bond

- Social Bond

- Mixed-Sustainability Bond

Green bonds lead the market because they fund eco-friendly projects and attract investors interested in supporting climate and sustainability efforts.

Industry Vertical Insights:

- Utilities

- Transport and Logistics

- Chemicals

- Food and Beverage

- Government

- Others

Utilities hold the largest share because they are deeply involved in big infrastructure projects, especially in energy, transmission, and water management.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America leads the sustainable finance market due to its advanced financial systems, high investor interest in ESG investments, and strong policy support for green finance.

Top Sustainable Finance Market Leaders:

- Acuity Knowledge Partners

- BNP Paribas

- Deutsche Bank AG

- Goldman Sachs Group Inc.

- KPMG International Limited

- London Stock Exchange Group plc

- Nomura Holdings Inc.

- PricewaterhouseCoopers LLP

- South Pole Group

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.