Mechanical Ventilator Market Size & Trends

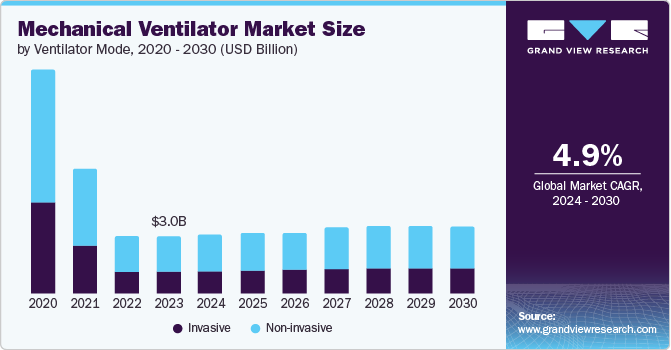

The global mechanical ventilator market size was estimated at USD 3.05 billion in 2023 and is projected to grow at a CAGR of 4.90% from 2024 to 2030. The increasing prevalence of chronic respiratory conditions such as chronic obstructive pulmonary disease (COPD), acute respiratory distress syndrome, asthma, obstructive sleep apnea, exertional dyspnea, and pulmonary embolism is fueling market growth. As of October 2023, National Council on Aging data indicates that Obstructive Sleep Apnea (OSA), characterized by irregular breathing and reduced oxygen supply to the brain, affects about 39 million adults in the U.S. and an estimated 936 million globally.

Furthermore, intensive research and development efforts focused on respiratory interventions and the introduction of innovative devices are anticipated to offer lucrative growth opportunities for the market in the coming years. Major players in the market are directing investments towards the development of cost-effective mechanical ventilators, with a favorable regulatory environment further facilitating market expansion. For instance, in July 2022 -Nihon Kohden OrangeMed, Inc. received U.S. FDA clearance for the NKV-330 Ventilator System. This system is non-invasive and provides respiratory support in emergencies.

Gather more insights about the market drivers, restrains and growth of the Mechanical Ventilator Market

The mechanical ventilator market is currently experiencing moderate growth with an accelerating pace, propelled by factors including a growing geriatric population, a substantial patient pool with respiratory disorders, and the introduction of technologically advanced devices. For example, in August 2023, Getinge received U.S. FDA clearance for its non-invasive wall gas-independent mechanical ventilator, Servo-air Lite.

In the mechanical ventilator market, a noteworthy emphasis has been placed on innovation to enhance patient comfort, compliance, efficacy, and overall treatment outcomes. The integration of smart technology and digital sensors plays a pivotal role in augmenting therapy management, contributing significantly to the market's momentum.

The market is witnessing an upswing in mergers and acquisitions, with companies strategically utilizing multiple acquisitions to bolster product portfolios, extend their global presence, diversify offerings, integrate technologies, and strengthen their positioning within the industry.

The prevalence of respiratory disorders globally introduces opportunities and competitive dynamics across various regions. Markets such as the United Kingdom (UK), Germany, France, Italy, and Spain are experiencing growth propelled by factors such as aging populations, lifestyle influences, healthcare reforms, and regulatory standardization. In contrast, the well-established markets in the U.S. and Canada exhibit high COPD prevalence rates and sophisticated healthcare systems.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- The global hysteroscopy instruments market size was estimated at USD 1.90 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030.

- The global home sleep apnea test market size was estimated at USD 2.18 billion in 2023 and is expected to grow at a CAGR of 6.4% from 2024 to 2030.

Key Companies profiled:

Some prominent players in the global mechanical ventilator market include

- Abbott

- Boston Scientific Corporation

- BIOTRONIK

- MicroPort Scientific Corporation

- Stryker

- ResMed

- Fisher & Paykel Healthcare Limited

- Drägerwerk AG & Co. KGaA

- Getinge AB

- ZOLL Medical Corporation (Asahi Kasei Corporation)

- Air Liquide

- VYAIRE MEDICAL, INC.

- GE Healthcare

- Hamilton Medical

- Smiths Group plc

- Allied Medical LLC (A Flexicare Company)

- aXcent Medical GmbH

- Metran Co., Ltd

- MAGNAMED

- Avasarala Technologies Limited

- Airon Corporation

- Bio-Med Devices

- Hill-Rom (Baxter)

- HEYER Medical AG

- Leistung Engineering Pvt. Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- NIHON KOHDEN CORPORATION

- Schiller AG

Key Mechanical Ventilator Company Insights

- In October 2022, Medtronic decided to separate its respiratory interventions (PMRI) and patient monitoring businesses from the ventilator market. The decision was made due to the company's significant expansion during the COVID-19 pandemic, which led to ventilator shortages.

- In January 2024, Koninklijke Philips N.V. announced the discontinuation of select respiratory products in the U.S. and its territories, including the ventilators, SimplyGo Mini, SimplyGo, and Everflo oxygen concentrators. This decision is expected to bring notable shifts in the ventilators market. According to a survey poll conducted by HME News in February 2024, approximately 70% of respondents believe that Philips' withdrawal from a significant portion of the U.S. respiratory market will have a considerable influence on the industry.

Recent Developments

- In January 2023, Getinge launched its latest mechanical ventilator, the Servo-c, which provides lung-protective therapeutic capabilities for pediatric and adult patients. The Servo-c utilizes modular parts, facilitating intelligent fleet management. This ensures optimal uptime and reduces costs, eliminating the necessity for proprietary disposables. Moreover, the Servo-c is equipped with CO2 monitoring and Servo Compass technology.

- In October 2021, Movair, a respiratory therapy company, launched Luisa, an advanced ventilator designed for diverse settings such as homes, hospitals, institutions, and portable applications. The U.S. commercial launch of Luisa comes in response to the growing demand for reliable and safe ventilators. Luisa is eligible for use under the FDA's Emergency Use Authorization.

Order a free sample PDF of the Mechanical Ventilator Market Intelligence Study, published by Grand View Research.