"Artificial Intelligence in Fintech Market – Industry Trends and Forecast to 2029

Global Artificial Intelligence in Fintech Market, By Component (Solutions and Services), Deployment Mode (Cloud and On-Premises), Application (Virtual Assistant, Business Analytics and Reporting, Customer Behavioural Analytics and Others) – Industry Trends and Forecast to 2029.

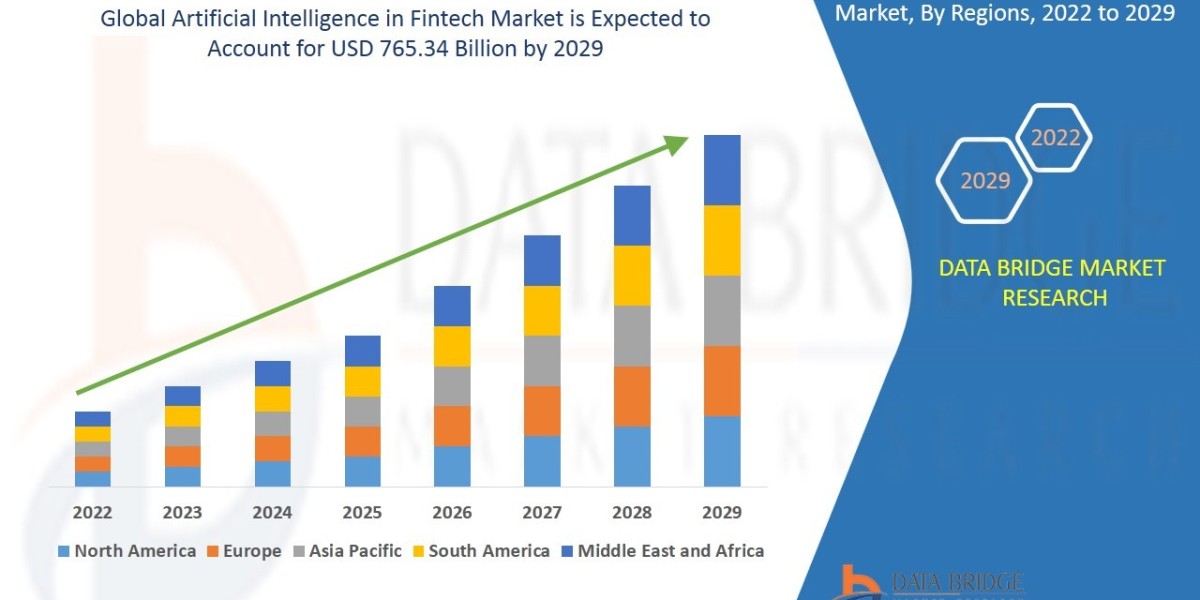

- Data Bridge Market Research analyses that the artificial intelligence in fintech market value, which was USD 13.14 billion in 2021, is expected to reach the value of USD 765.34 billion by 2029, at a CAGR of 66.20% during the forecast period. “Cloud" accounts for the largest deployment mode segment in the artificial intelligence in fintech market owing to the growing number of small and medium scale enterprises.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-ai-in-fintech-market

From the name itself, it is clear that fintech or financial technology is the incorporation of advanced technologies such as artificial intelligence with the financial services which helps to protect against fraudulent activities. The role of artificial intelligence in fintech is to facilitate the operation of robo-advisors to provide financial planning services.

The Artificial Intelligence (AI) in Fintech market is experiencing rapid growth and evolution driven by advancements in technology and a push towards digital transformation within the financial industry. AI in Fintech is mainly used for fraud detection, customer service, personal finance, and investment management, among other applications. The market is characterized by the integration of machine learning algorithms, natural language processing, and predictive analytics to enhance decision-making processes and deliver personalized experiences to users. The global AI in Fintech market is projected to witness substantial growth in the coming years, with a CAGR of over 20% during the forecast period.

**Segments**

- **By Component**

- Software

- Services

- **By Application**

- Virtual Assistants

- Business Analytics and Reporting

- Customer Behavioral Analytics

- Others

- **By Deployment Mode**

- Cloud

- On-Premises

- **By End-User**

- Banking

- Insurance

- Investment Management

- Others

**Market Players**

- IBM Corporation

- Microsoft

- Google

- Oracle

- SAP

- Intel

- Salesforce

- IPsoft

- Palantir

- Lexalytics

The key players in the AI in Fintech market are investing heavily in research and development to launch innovative products and gain a competitive edge. Companies are focusing on strategic partnerships, collaborations, and acquisitions to expand their market presence and cater to the growing demand for AI solutions in the financial sector. IBM Corporation, Microsoft, Google, Oracle, and SAP are some of the prominent players in the market, offering a wide range of AI solutions tailored to the unique needs of financial institutions. These players are leveraging AI technologies to automate repetitive tasks, improve data analysis, and enhance customer experience, driving the adoption of AI in the Fintech industry.

In conclusion, the AI in Fintech market presents significant opportunities for growth and innovation, with AI applications transforming various aspects of theThe AI in Fintech market is witnessing a surge in growth propelled by technological advancements and the increasing shift towards digitalization in the financial sector. This trend is being driven by the need for more robust fraud detection mechanisms, improved customer service experiences, personalized financial solutions, and efficient investment management tools. As AI continues to permeate various segments of the financial industry, the integration of sophisticated technologies such as machine learning algorithms, natural language processing, and predictive analytics is revolutionizing decision-making processes and enabling financial institutions to deliver tailored services to their clientele.

Segmentation of the AI in Fintech market reveals key areas of focus for industry players. By component, the market is divided into software and services, with both segments witnessing significant growth as organizations seek comprehensive AI solutions to enhance their operational efficiency. Virtual Assistants, Business Analytics, Customer Behavioral Analytics, and other applications are driving the market's expansion, highlighting the diverse use cases of AI in financial services. Additionally, the deployment mode, whether cloud-based or on-premises, and the end-users such as banking, insurance, investment management, and others play a crucial role in shaping the market landscape.

Leading market players such as IBM Corporation, Microsoft, Google, Oracle, and SAP are at the forefront of innovation within the AI in Fintech sector, continuously investing in research and development to introduce cutting-edge solutions. These companies are actively forming strategic partnerships, engaging in collaborations, and making strategic acquisitions to broaden their market reach and cater to the escalating demand for AI-driven technologies in the financial domain. By offering a diverse array of AI solutions tailored to the specific requirements of financial institutions, these key players are streamlining processes, enhancing data analytics capabilities, and elevating customer experiences in the Fintech industry.

The future outlook for the AI in Fintech market is promising, with substantial opportunities for growth and advancement on the horizon. As AI applications continue to redefine traditional financial practices, the industry is poised to witness a paradigm shift in how services are delivered and### Global Artificial Intelligence in Fintech Market Analysis

**Segments:**

- By Component: The AI in Fintech market is primarily segmented by software and services, both witnessing robust growth as organizations seek comprehensive solutions for operational efficiency.

- By Application: Key applications driving market expansion include Virtual Assistants, Business Analytics, Customer Behavioral Analytics, and other innovative uses of AI in financial services.

- By Deployment Mode: The choice between cloud-based and on-premises solutions plays a pivotal role in shaping market dynamics.

- By End-User: Sectors such as banking, insurance, investment management, and others are adopting AI solutions to enhance their services and competitive edge.

**Market Players:**

Leading companies like IBM Corporation, Microsoft, Google, Oracle, and SAP are forefront innovators in the AI in Fintech sector. These key players are actively investing in R&D, forming strategic partnerships, and engaging in collaborations to cater to the escalating demand for AI technologies in finance. By offering tailored solutions, they are streamlining processes, enhancing data analytics, and improving customer experiences in the Fintech industry.

The integration of advanced technologies such as machine learning, natural language processing, and predictive analytics is revolutionizing decision-making processes within the financial realm. These technologies not only automate tasks but also improve data analysis, aiding in personalized financial solutions and efficient investment management. The surge in growth in the AI in Fintech market is also driven by the need for robust fraud detection mechanisms and enhanced customer service experiences

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global Artificial Intelligence in Fintech Market Landscape

Part 04: Global Artificial Intelligence in Fintech Market Sizing

Part 05: Global Artificial Intelligence in Fintech Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Artificial Intelligence in Fintech Key Benefits over Global Competitors:

- The report provides a qualitative and quantitative analysis of the Artificial Intelligence in Fintech Market trends, forecasts, and market size to determine new opportunities.

- Porter’s Five Forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make strategic business decisions and determine the level of competition in the industry.

- Top impacting factors & major investment pockets are highlighted in the research.

- The major countries in each region are analyzed and their revenue contribution is mentioned.

- The market player positioning segment provides an understanding of the current position of the market players active in the Personal Care Ingredients

Browse Trending Reports:

Hydroxychloroquine Market

Acromegaly Market

Smart Exoskeleton Market

Psoriatic Arthritis Psa Market

Graves Disease Overactive Thyroid Market

Meningococcal Disease Vaccine Market

Healthcare Advertising Market

Siding Market

Fruit Concentrate Puree Market

Non Woven Fabric Market

Dairy Protein Ingredients Market

Membrane Bioreactor System Market

Rapid Diagnostic Tests Rdt Market

Phthalic Anhydride Market

Pour Point Depressant Market

Physiological Monitors Market

Xanthohumol Market

Tissue Paper Market

Methylxanthines Market

Sapphire Camera Market

Sensor Data Analytics Market

Sleeping Medications Market

Incretin Mimetics Market

Automotive Composites Market

Organic Fertilizers Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975