The global heat pump market size was estimated at USD 88.7 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030. Favorable government policies for energy-efficient solutions and lowering carbon footprint are anticipated to boost market growth over the forecast period. Many governments are providing subsidies or incentives and tax credits & rebates for the installation of heat pumps are expected to further fuel the demand for energy-efficient heat pumps, thereby, benefitting the growth of heat pump industry.

According to the U.S. Department of Energy, a 30% tax credit can be claimed for buying a property in the U.S. that has qualified heat pumps installed in connection with an existing or new dwelling unit. Italy's Conto Termico incentive scheme provides grants that cover 30-35% of costs of installing renewable heating systems in buildings. Australia also provides national grants to municipals for heat pump installation. Moreover, heat pump industry is significantly affected by the availability of raw materials, such as metals like iron & steel, adhesives, rubber, chemicals, and plastics. Thus, fluctuations in raw material prices have a direct impact on manufacturing costs, which can limit market growth to some extent.

Gather more insights about the market drivers, restrains and growth of the Heat Pump Market

Market Dynamics

As per the International Energy Agency, heat pumps continue to cover only a small portion of domestic heat demand, while fossil fuel-based solutions accounted for roughly half of the global heating equipment sales in 2022, with majority of heat pumps being installed in new buildings. However, various factors including regulatory development, enhanced construction requirements favoring heat pumps in new buildings, and rising air conditioning demand are likely to boost the adoption of heat pump technologies in the coming years.

Technology Insights

The air-source technology segment dominated the market in 2023 by accounting for a share of over 84.6%. Air source heat pump works through wet central heating systems to heat radiators and provides hot water. Similar to a refrigerator, these pumps absorb heat and transfer it to other mediums. The majority of air-source heat pump integrations involve air-to-air heat pumps, which warm or cool air. Its ability to provide water-heating solutions along with heating and cooling of space is expected to boost demand for air source technology over forecast years. In February 2023, LG introduced an air source heat pump (ASHP) capable of heating 200-270 liters of residential water. The pump has a coefficient of performance (COP) of up to 3.85 and uses R134a as a refrigerant.

Capacity Insights

The heat pump segment with up to 10-20 kW capacity accounted for a market share of 21.3% in 2023. The growth is attributed to capacity type being suitable for a wide range of uses such as in hotels, swimming pools, factories, restaurants, and schools. The majority of heat pumps in this capacity provide quiet operation, are environment-friendly, offer high efficiency, and have a wide range of hydraulic options and communication protocols. ThermoWise, a heat pump with a 10-20 kW capacity introduced its new product DKRS-200SN4-M2. This particular product is capable of maintaining its temperature at a high 65 degrees Celsius and it widely caters to schools, prisons, and hotels, among others where higher demand for hot water is required.

Operation Type Insights

The electric operation type segment accounted for a revenue share of 86.0% in 2023. An electric heat pump utilizes electricity to transfer heat from a cool space to a warm space. These heat pumps are not only used for heating but also for cooling during the summer season. Owing to the benefits of electric heat pumps such as better air quality, energy efficiency, quiet operation, safer than gas pumps, and others segment demand is expected to showcase lucrative growth.

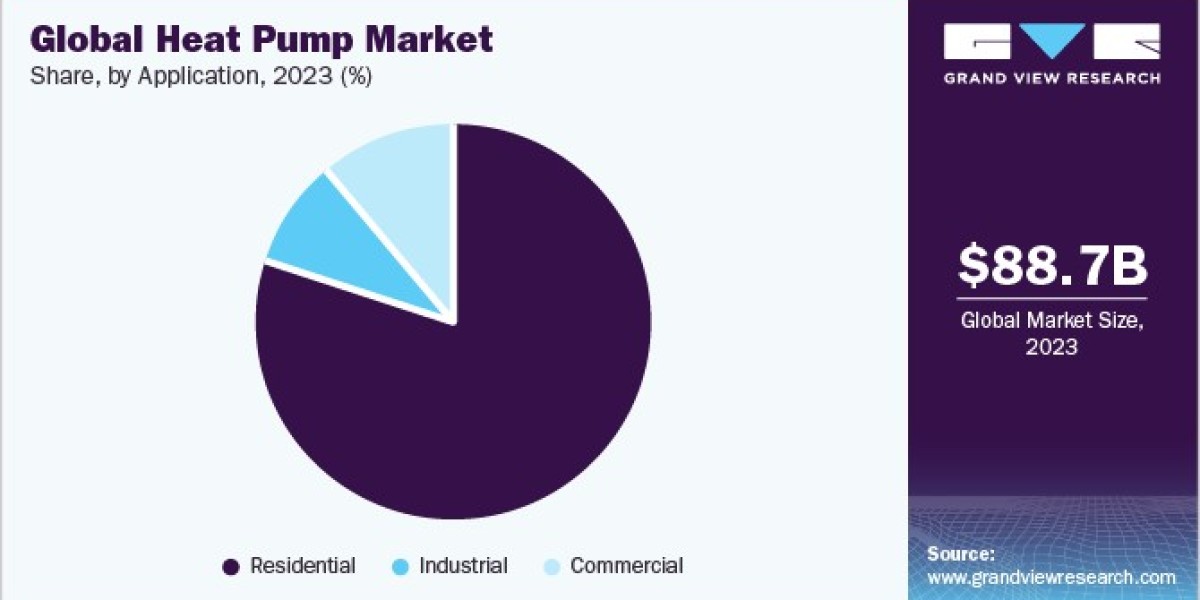

Application Insights

The residential application segment dominated the market in 2023 by accounting for a revenue share of over 86.0%. Rapid urbanization coupled with increasing demand for energy-efficient products is expected to drive demand for heat pumps in residential sector. Favorable government initiatives and tax rebates offered on energy-saving product installation are also expected to propel demand for heat pumps over coming years.

Regional Insights

Asia Pacific led the market and accounted for 52.6% of the global revenue share in 2023. Asia Pacific is characterized by the availability of large skilled labor at low cost. The rising trend of shifting production bases to emerging economies, mainly China and India, is expected to positively influence market growth over the forecast period. Energy-saving solutions are expected to gain high prominence in countries such as China, Japan, Indonesia, and India.

Browse through Grand View Research's Advanced Interior Materials Industry Research Reports.

- The global ceramic tiles market size was estimated at USD 186.70 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030.

- The global metal casting market size was valued at USD 136.71 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030.

Key Companies profiled:

- Carrier

- Daikin Industries, Ltd

- Robert Bosch GmbH

- Lennox International

- Johnson Controls, Inc.

- Midea Group

- Hitachi, Ltd.

- Ingersoll Rand Plc.

- Rheem Manufacturing Company

- HAIER(GENERAL ELECTRIC)

- Panasonic Holdings Corporation

- Danfoss

- Fujitsu

- LG Electronics, Inc.

- Samsung

Heat Pump Market Segmentation

Grand View Research has segmented the global heat pump market based on technology, capacity, operation type, application, and region:

Heat Pump Technology Outlook (Revenue, USD Billion, 2018 - 2030)

- Air Source

- Air to Air

- Air to Water

- Water Source

- Geothermal

Heat Pump Capacity Outlook (Revenue, USD Billion, 2018 - 2030)

- Up to 10 kW

- 10-20 kW

- 20-50 kW

- 50-100 kW

- 100-200 kW

- Above 200 kW

Heat Pump Operation Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Electric

- Hybrid

Heat Pump Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Residential

- Industrial

- Commercial

Heat Pump Region Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- Sweden

- Norway

- Spain

- Finland

- Asia Pacific

- China

- Japan

- Australia

- India

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- UAE

- Saudi Arabia

Order a free sample PDF of the Heat Pump Market Intelligence Study, published by Grand View Research.

Recent Developments

- In January 2023, Johnson Controls acquired Hybrid Energy AS. Hybrid Energy's innovative technology will provide customers with fresh, cost-effective solutions while tackling decarbonization and sustainability efforts in Europe and beyond.