The global patient engagement solutions market size was valued at USD 22.7 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.7% from 2024 to 2030. Growing technological developments, adoption of EHR and mhealth solutions, prevalence of chronic diseases, supportive initiatives by key market stakeholders, and consumerism in healthcare are some of the key drivers of this market. As per a 2021 survey by NextGen Healthcare,83% of ambulatory healthcare survey respondents believed that patient engagement solutions played a key role in organizational financial success and patient outcomes. The survey also indicated that COVID-19 pandemic fueled the market growth.

COVID-19 had unprecedented consequences on daily lives and the global economy. A significant burden is formed on healthcare systems across the globe. Providers, payers, and life science companies started looking for solutions to increase patient engagement in various settings, such as remote home monitoring, virtual consultations, and clinical trials. Pandemic and the resulting movement restrictions propelled the need to facilitate virtual communication between customers and their care providers. This led to a surge in demand for patient engagement solutions during 2020. This growth, however, was observed to have dampened during 2021, and the market is anticipated to grow notably at a steady rate over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Patient Engagement Solutions Market

Detailed Segmentation:

Delivery Type Insights

In 2023, the web and cloud-based segment dominated the market with a 78.0% revenue share and is expected to grow at the fastest rate throughout the forecast period. Increased adoption of these solutions is driven by remote access to real-time data tracking, integrated features, easy accessibility, minimal handling costs, and straightforward data backup. Due to the aforementioned reasons, companies are increasingly investing in web and cloud-based patient engagement solutions.

Component Insights

In 2023, software and hardware segment accounted for the largest revenue share of 62.7% and is expected to grow at the fastest CAGR over the forecast period. Patient engagement software and hardware form core offering of the solution. It is simple to install, use, and retrieve records owing to intuitive user interfaces and continuous product upgrades. FollowMyHealth from Allscripts is a popular mobile-first, customizable, enterprise patient engagement solution. It is used by providers, hospitals, and health systems to drive the quality of care and increase patient satisfaction.

Functionality Insights

The communication segment accounted for the largest revenue share of 35.0% in 2023, as it forms the core offering of any patient engagement solution. This large share is attributed to a surge in demand and adoption of telehealth, mhealth, and other virtual communication solutions via audio, video, and text. The pandemic helped to adopt virtual communication solutions and expanded applications to remote patient monitoring, mental health, and many more modalities.

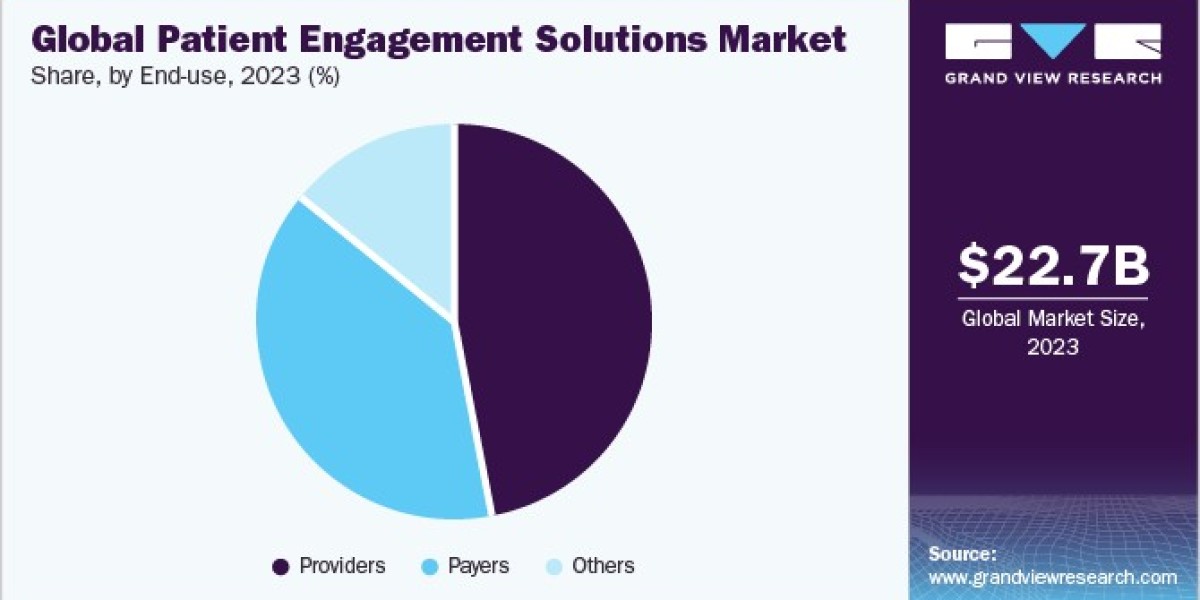

End-use Insights

The providers segment held the largest revenue share of over 47.0% in 2023. Providers serve the largest volume of patients and are also primary line of treatment for consultation from general to specialist health concerns. These end-users are, thus, largest adopters of patient engagement solutions. In December 2021, Northwell Health in the U.S. deployed a patient engagement platform by Playback Health at its select clinical sites to promote mobility and share point-of-care medical data while adhering to security standards for health information.

Therapeutic Area Insights

Chronic disease management dominated the market in 2023 with a revenue share of over 44.7%. Rising geriatric population in key markets, prevalence of chronic diseases, and adoption of digital technologies catalyzed by COVID-19 pandemic have contributed to a large share of the segment. Patient engagement solutions support chronic disease management by facilitating prevention and detection of the condition, along with managing the condition with the provider or through self-management.

Application Insights

Outpatient health management dominated the market and held a revenue share of over 39.0% in 2023. The other application segment, which includes R&D and preventive care, is anticipated to expand at the fastest rate of 18.0% over the forecast period. Patients diagnosed with chronic disorders need to be monitored and kept updated about managing their ailment. The rising healthcare consumerism has also led to patients becoming more involved in care planning, tracking, and optimization.

Regional Insights

North America held the largest revenue share of over 35.0% in 2023 due to presence of key players, increasing adoption of mhealth and EHR, and growing investment in patient engagement software by major companies. Increasing awareness levels and government spending on healthcare sector are expected to accelerate the growth. Europe held the second-largest share in 2023 owing to publicly funded systems such as the UK National Health Services (NHS). By 2020, the NHS planned to go completely paperless and provide patients access to EHRs since 2018.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

• The global computerized physician order entry market size was valued at USD 1.94 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. This growth trajectory can be attributed to an escalating demand for precise and efficient data exchange between patients and healthcare entities, including hospitals, laboratories, and clinics.

• The global healthcare cloud computing market size was valued at USD 19.6 billion in 2023 and is projected to grow at a CAGR of 12.7% from 2024 to 2030. The rise in the prevalence of chronic diseases and the geriatric population demands an integrated information system, which acts as a significant contributing factor for the healthcare cloud computing market to grow.

Key Patient Engagement Solutions Company Insights

• In December 2022, EnlivenHealth, the retail pharmacy solutions division of Omnicell, Inc., introduced the Patient Engagement Network (PEN). This comprehensive solution integrates EnlivenHealth's national pharmacy network with advanced data insights and digital engagement technologies, aiming to enhance patient health outcomes, boost brand loyalty, and drive revenue growth.

• In March 2022, UST and Well-Beat, an Israeli start-up, collaborated to create a pioneering digital patient engagement SaaS solution. Compatible with existing Electronic Health Record (EHR) systems and connected devices, the solution eliminates the need for changes to clinical workflows or onboarding to a new platform. Administrators gain a blockchain-based patented tool to assess the patient ecosystem, enhancing existing EHR capabilities through a unique set of APIs.

• In March 2020, PatientPoint, an engagement solutions provider, introduced three new digital products— hospital bedside tablet PatientPoint Interact—Hospital, mobile solution PatientPoint Extend, and the adherence-focused infusion suite tablet PatientPoint Infuse. These extend the digital footprint of patient education and engagement, enhancing communication across additional points of care.

Key Companies profiled:

• Cerner Corporation (Oracle)

• NextGen Healthcare, Inc.

• Epic Systems Corporation

• Allscripts Healthcare, LLC

• McKesson Corporation

• ResMed

• Koninklijke Philips N.V.

• Klara Technologies, Inc.

• CPSI

• Experian Information Solutions, Inc.

• athenahealth, Inc.

• Solutionreach, Inc.

• IBM

• MEDHOST

• Nuance Communications, Inc.

Patient Engagement Solutions Market Segmentation

Grand View Research has segmented the global patient engagement solutions market based on delivery type, component, functionality, therapeutic area, application, end-use, and region:

Patient Engagement Solutions Delivery Type Outlook (Revenue, USD Million, 2018 - 2030)

• Web & Cloud-based

• On-premise

Patient Engagement Solutions Component Outlook (Revenue, USD Million, 2018 - 2030)

• Software & Hardware

o Standalone

o Integrated

• Services

o Consulting

o Implementation & Training

o Support & Maintenance

o Others

Patient Engagement Solutions Functionality Outlook (Revenue, USD Million, 2018 - 2030)

• Communication

• Health Tracking & Insights

• Billing & Payments

• Administrative

• Patient Education

• Others

Patient Engagement Solutions Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

• Health & Wellness

• Chronic Disease Management

• Others

Patient Engagement Solutions Application Outlook (Revenue, USD Million, 2018 - 2030)

• Population Health Management

• Outpatient Health Management

• In-patient Health Management

• Others

Patient Engagement Solutions End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Payers

• Providers

• Others

Patient Engagement Solutions Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o Germany

o UK

o France

o Italy

o Spain

o Sweden

o Norway

• Asia Pacific

o China

o India

o Japan

o Australia

o South Korea

• Latin America

o Brazil

o Mexico

o Argentina

• MEA

o South Africa

o Saudi Arabia

o Kuwait

o UAE

Order a free sample PDF of the Patient Engagement Solutions Market Intelligence Study, published by Grand View Research.