Summary:

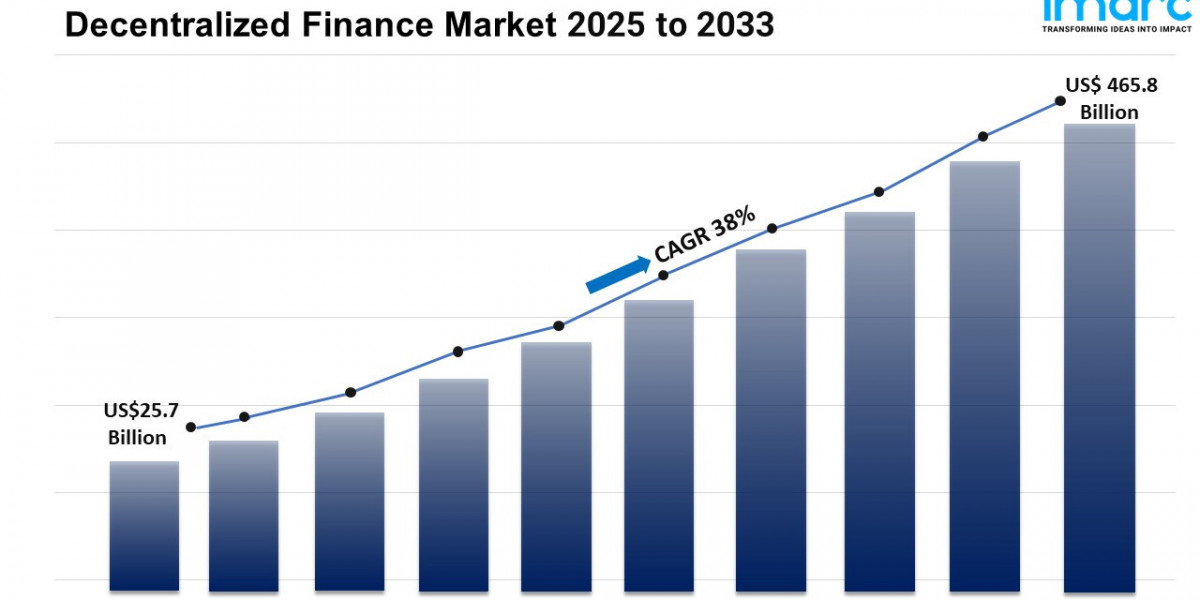

- The globaldecentralized finance marketsize reached USD25.7Billionin 2024.

- The market is expected to reach USD465.8Billionby 2033, exhibiting a growth rate (CAGR) of38%during 2025-2033.

- North America leads the market, accounting for the largest decentralized finance market share.

- Blockchain technology accounts for the majority of the market share in the component segment due to its foundational role in enabling secure and transparent decentralized transactions and smart contracts.

- Data and analytics hold the largest share in the decentralized finance industry.

- The widespread adoption of blockchain technology is a primary driver of the decentralized finance market.

- The growing demand for financial inclusion and increasing interest in cryptocurrencies are reshaping the decentralized finance market.

Industry Trends and Drivers:

- Increased Adoption of Blockchain Technology

The adoption of blockchain technology is growing as users and institutions begin to appreciate its inherent benefits, such as enhanced transparency and security. This increased awareness is driving the popularity of decentralized finance (DeFi) applications. Additionally, blockchain's decentralized nature allows for transactions and data management without centralized control, significantly reducing the risk of fraud and enhancing trust among users. Moreover, DeFi applications utilize these features to create financial services that operate on transparent and immutable protocols, attracting tech-savvy individuals and forward-thinking institutions. As blockchain technology becomes more mainstream, the infrastructure and user interfaces of DeFi platforms continue to improve, making them more accessible to a broader audience across the globe.

- Rising Demand for Financial Inclusion

DeFi platforms are widely recognized for their role in promoting financial inclusion by providing access to financial services for populations traditionally underserved by conventional banking systems. These platforms offer essential services like banking, lending, and investing without the need for traditional financial intermediaries. Additionally, decentralized finance enables secure and transparent transactions by leveraging blockchain technology, allowing users from any geographic location with internet access to participate. This accessibility is particularly transformative in regions where conventional banking infrastructure is limited or non-existent, enabling individuals and businesses to engage in financial activities that were previously out of reach. The growth of DeFi could dramatically alter the financial market by democratizing access to financial services and fostering economic empowerment on a global scale.

- Growing Interest in Cryptocurrencies

As cryptocurrencies gain traction globally, there is a corresponding increase in interest in DeFi platforms, which are intrinsically linked to various digital assets. Additionally, cryptocurrencies serve as the foundation for many DeFi applications, which use these digital currencies for a range of services, including loans, interest-bearing accounts, and peer-to-peer transactions. Moreover, the rising popularity of cryptocurrencies like Bitcoin and Ethereum has brought more attention to DeFi platforms, as they offer innovative uses for these assets beyond mere speculation. Besides, the volatility of cryptocurrencies has prompted investors to explore DeFi to stabilize returns and leverage their digital assets more effectively. As the cryptocurrency market grows, the integration with DeFi platforms is expected to become more seamless, further fueling interest from casual crypto enthusiasts and serious investors looking to diversify their financial strategies within the blockchain ecosystem.

Request Sample For PDF Report:https://www.imarcgroup.com/decentralized-finance-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

- Blockchain Technology

- Decentralized Applications (dApps)

- Smart Contracts

Blockchain technology represents the largest segment due to its foundational role in enabling secure and transparent decentralized transactions and smart contracts.

Breakup by Application:

- Assets Tokenization

- Compliance and Identity

- Marketplaces and Liquidity

- Payments

- Data and Analytics

- Decentralized Exchanges

- Prediction Industry

- Stablecoins

- Others

Data and analytics account for the largest market share as they provide essential insights and drive decision-making processes within DeFi platforms.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America holds the leading position owing to a large market for decentralized finance driven by its advanced financial infrastructure, widespread technological adoption, and supportive regulatory environment for decentralized finance innovations.

Top Decentralized Finance Market Leaders:

- BadgerDAO

- Balancer

- Bancor Network

- MakerDAO

- SushiSwap

- Synthetix

- Uniswap Labs

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.