Summary:

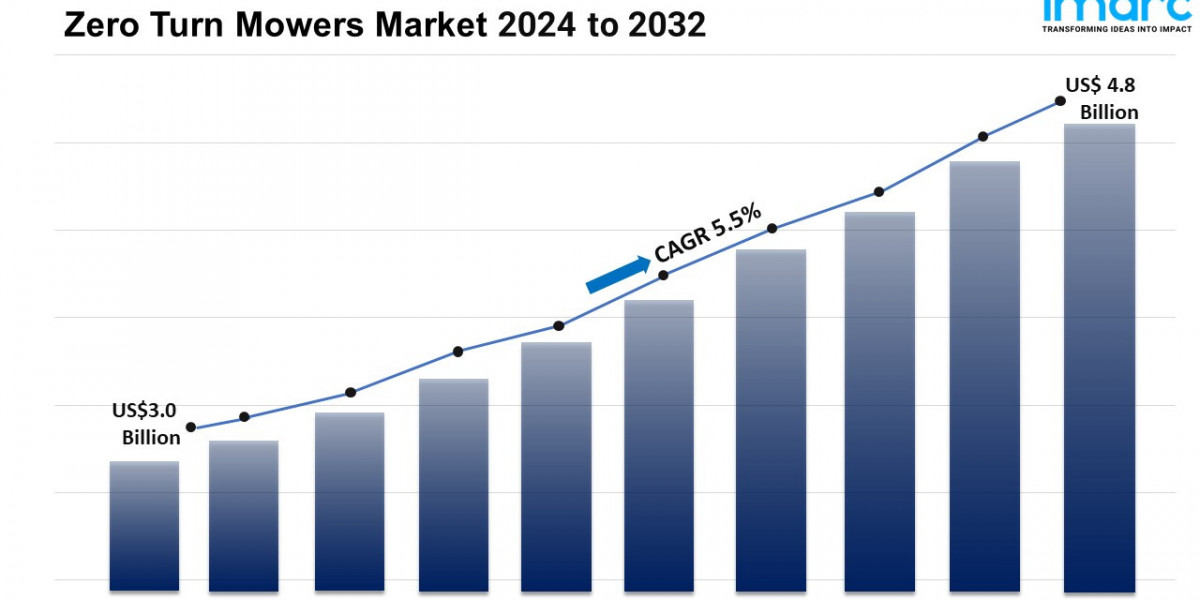

- The global zero turn mowers market size reached USD 3.0 Billion in 2023.

- The market is expected to reach USD4.8 Billion by 2032, exhibiting a growth rate (CAGR) of 5.5% during 2024-2032.

- North America leads the market, accounting for the largest zero turn mowers market share.

- More than 60 inches accounts for the majority of the market share in the cutting width segment due to the increasing demand for efficiency in large-area lawn care, where wider cutting widths significantly reduce mowing time and labor costs.

- Residential holds the largest share in the zero turn mowers industry.

- The rising interest in lawn care is a primary driver of the zero turn mowers market.

- Technological advancements and the expanding commercial industry are reshaping the zero turn mowers market.

Industry Trends and Drivers:

- Increasing Interest in Lawn Care:

The growing enthusiasm for DIY lawn care and gardening has been heavily influenced by social media platforms and home improvement shows, which showcase immaculate lawns and inspire homeowners to take on their landscaping projects. As a result, several consumers are seeking efficient tools to help them achieve professional-grade results in their yards. Moreover, zero-turn mowers are gaining popularity due to their ability to provide a clean, precise cut, drastically reducing the time and effort required for lawn maintenance. These mowers offer better maneuverability compared to traditional models, allowing users to navigate around obstacles like trees and flower beds easily. The trend toward outdoor home improvement has also been bolstered by the desire for well-maintained outdoor spaces, whether for personal enjoyment or to increase property value.

- Technological Advancements:

The emerging technological advancements in the design and functionality of zero-turn mowers have significantly enhanced their appeal to homeowners and professional landscapers. Additionally, innovations such as more powerful engines, advanced cutting technologies, and improved fuel efficiency have led to mowers that perform better and last longer. Some models now come equipped with GPS tracking and automated mowing systems, making it easier for users to maintain large lawns with minimal effort. These features offer a hands-off experience, enabling precise cuts and saving time on routine maintenance tasks. Moreover, advancements in ergonomic designs have improved comfort for operators, allowing for longer use with less physical strain. These technological improvements enhance the user experience and ensure that the mowers deliver consistent, high-quality results.

- Growing Commercial Sector:

The commercial industry is experiencing robust growth, and zero-turn mowers are becoming a staple for landscaping companies due to their efficiency and ability to handle large areas quickly. Additionally, professional landscapers rely on these mowers for their speed, precision, and durability, which allow them to complete jobs faster and with fewer labor costs. Moreover, the efficiency of zero-turn mowers also translates into higher profitability for commercial landscaping firms, as they can take on more projects in a shorter amount of time. Moreover, various cities and municipalities are investing in well-maintained green spaces, further driving the need for commercial landscaping services equipped with top-tier mowing technology. As the commercial landscaping sector continues to expand, the market for zero-turn mowers is expected to grow in parallel, fueled by the demand for reliable and efficient mowing solutions.

Request Sample For PDF Report: https://www.imarcgroup.com/zero-turn-mowers-market/requestsample

Market Report Segmentation:

Breakup by Cutting Width:

- Less than 50 inches

- 50 to 60 inches

- More than 60 inches

More than 60 inches represents the largest segment due to the increasing demand for efficiency in large-area lawn care, where wider cutting widths significantly reduce mowing time and labor costs.

Breakup by Application:

- Residential

- Commercial

Residential accounts for the largest market share due to the growing trend among homeowners toward maintaining expansive lawns and gardens, coupled with the rising popularity of zero-turn mowers for their maneuverability and ease of use.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America holds the leading position owing to a large market for zero turn mowers driven by a combination of high disposable incomes, a strong culture of lawn care, and the widespread adoption of advanced mowing technologies among both residential and commercial users.

Top Zero Turn Mowers Market Leaders:

- Ariens Company

- BigDog Mower Co.

- Briggs & Stratton LLC.

- Husqvarna AB

- Deere & Company

- Kubota Corporation

- Mtd Products Inc

- Spartan Mowers

- Swisher Inc

- The Toro Company

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.