Introduction

The Usage-Based Insurance (UBI) market is experiencing rapid growth, driven by advancements in telematics, data analytics, and the increasing demand for personalized insurance solutions. UBI offers a dynamic approach to insurance, allowing insurers to tailor policies based on real-time driving behavior, reducing risks and promoting safer driving practices.

Market Values

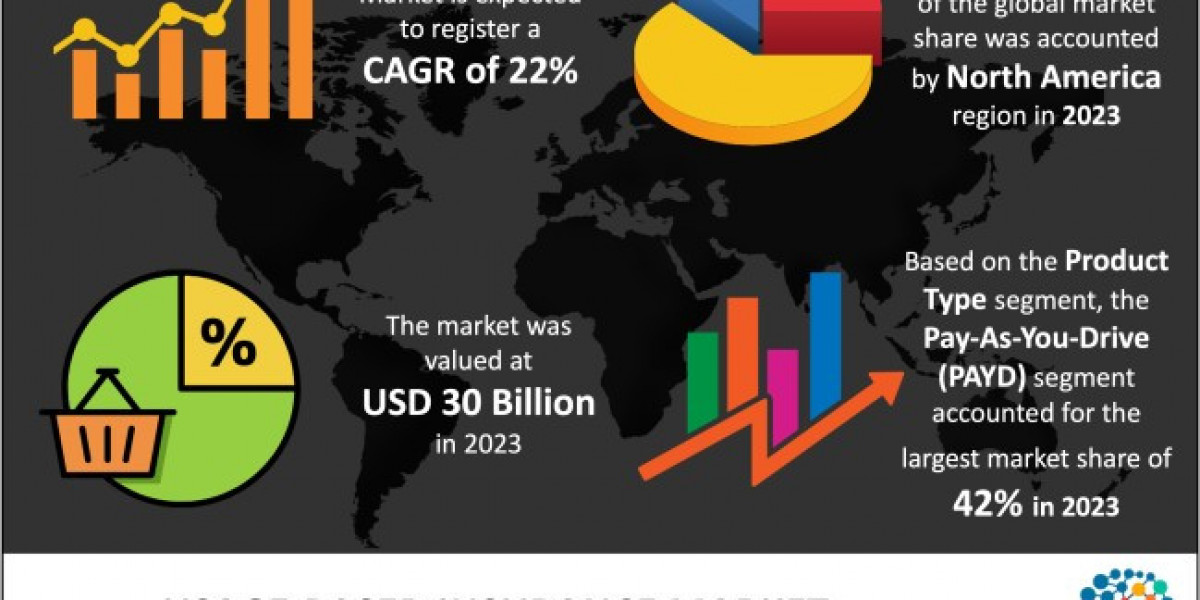

The global usage-based insurance market was valued at USD 30 billion in 2023 and grew at a CAGR of 22% from 2024 to 2033. The market is expected to reach USD 219.13 billion by 2033.

Request to Download Sample Research Report- https://www.thebrainyinsights.com/enquiry/sample-request/14105

Market Dynamics

Drivers:

- Increasing vehicle digitization

- Demand for personalized and flexible insurance solutions

- Rise in connected car technologies

- Adoption of telematics data for risk assessment

Restraints:

- High implementation costs

- Concerns around data privacy and security

Opportunities:

- Expansion of UBI models in emerging markets

- Integration of AI and machine learning for predictive analytics

Market Segmentation

- By Application

- Private Vehicles

- Commercial Vehicles

- Fleets

- By Vehicle Type

- Passenger Cars

- Commercial Vehicles (Trucks, Buses)

- By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Recent Developments

- Launch of advanced telematics solutions to monitor driver behavior

- Partnerships between insurers and technology providers for innovative UBI solutions

- Development of policies incorporating advanced AI and data analytics

- Integration of blockchain for secure data management in UBI

Key Players

- Allianz SE

- Allstate Corporation

- Aviva Life Insurance

- AXA

- Insurethebox

- Liberty Mutual Insurance Company

- Mapfre S.A

- Nationwide Mutual Insurance Company

- Progressive Casualty Insurance Company

- UNIPOLSAI ASSICURAZIONI S.P.A