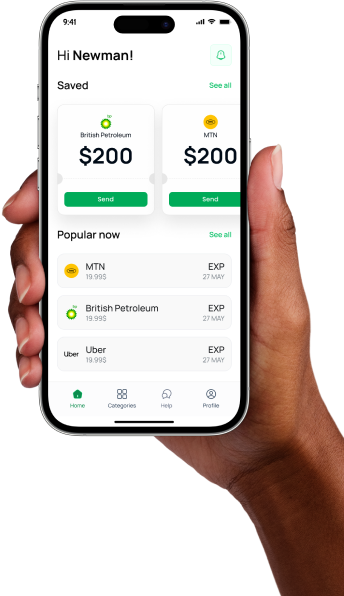

The digital age has transformed how we manage financial transactions, with the Voucher Remittance Platform leading the charge in innovative payment solutions. These platforms provide a secure and efficient way to manage, send, and redeem vouchers, revolutionizing the traditional remittance system. By digitizing the voucher system, these platforms offer users the ability to conduct transactions from anywhere in the world, reducing the need for physical exchange and making the process faster and more reliable.

Why Choose a Voucher-Based System?

A voucher-based system offers unparalleled convenience by allowing users to pre-purchase credits that can be used later for a variety of services, from shopping to bill payments. This system is particularly beneficial in regions where access to banking services is limited or where many transactions are still conducted in cash. The flexibility of using a voucher system helps bridge the gap between cash-based and digital economies, providing a seamless transition for users adapting to digital financial services.

Advantages of Digital Vouchers

Digital vouchers carry several advantages over traditional paper vouchers. They are less susceptible to theft and loss, easier to track, and can be redeemed instantly. Moreover, the use of a Voucher Remittance Platform enhances transparency in transactions. Every transaction is recorded, allowing users and businesses to track their spending and remittance history with ease. This level of accountability is crucial for companies that require precise financial tracking and for individuals who want to manage their budgets effectively.

Vouchers Africa: A Case Study

Vouchers Africa represents a successful implementation of digital voucher systems across the continent. By leveraging the power of digital vouchers, this initiative has facilitated a smoother transaction process for countless users. Businesses across Africa are now able to offer more versatile payment options to their customers, boosting customer satisfaction and loyalty. Furthermore, Vouchers Africa has enabled a broader reach, helping businesses tap into new markets and customer bases previously inaccessible due to the limitations of traditional payment methods.

The Future of Vouchers in Global Commerce

The potential for expansion in the voucher market is immense, particularly with the increasing integration of blockchain technology. This integration promises enhanced security and further improvements in the efficiency of transactions. As digital voucher systems become more widespread, they are set to play a pivotal role in the future of global commerce, providing a bridge between various economic sectors and fostering an inclusive environment for business transactions worldwide.

Conclusion:

In an increasingly connected world, the efficiency and security of financial transactions are paramount. Voucher Remittance Platforms and initiatives like Vouchers Africa are at the forefront of transforming financial interactions across the globe. For those looking to explore the possibilities of digital vouchers and innovative remittance solutions, visiting lipaworld.com offers a gateway to a range of options that combine security with convenience, ensuring that every transaction is not only seamless but also broadens financial access and inclusion.

Blog Source URL: https://sites.google.com/view/groceryvoucherkenya/the-digital-age-has-transformed-how-we-manage-financial-transactions-with