The automotive axle market is witnessing a surge in mergers, acquisitions, and strategic collaborations as key players seek to expand their market presence, enhance technological capabilities, and strengthen supply chain networks. With the growing demand for advanced axle systems, particularly for electric and hybrid vehicles, companies are focusing on consolidations to improve production efficiency and accelerate innovation. This trend is reshaping the competitive landscape and fostering growth opportunities across the global market.

Key Drivers Behind Mergers and Acquisitions in the Automotive Axle Market

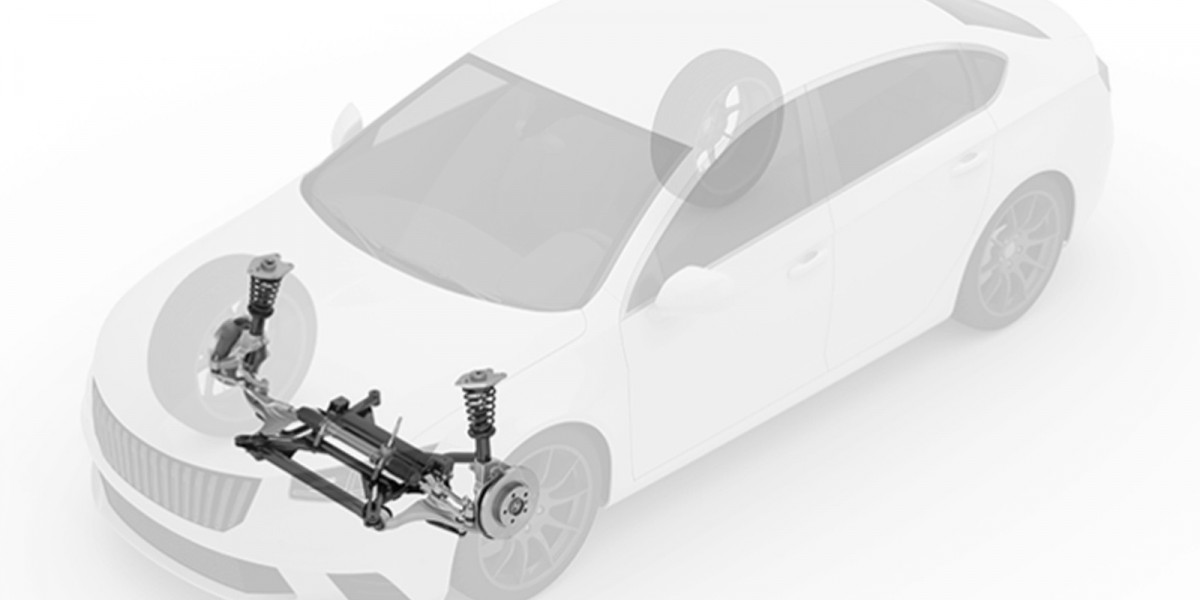

Technological Advancements in Axle Systems

As the automotive industry shifts towards electrification and automation, manufacturers are acquiring or partnering with technology-driven companies to integrate smart axle solutions.

- Companies are investing in e-axles, which combine electric motors and transmissions into a single unit, reducing weight and improving vehicle efficiency.

- Advanced lightweight materials are being incorporated into axle designs to enhance fuel efficiency in conventional and electric vehicles.

- Collaborations with AI and automation firms are enabling the development of intelligent axle systems for autonomous vehicles.

Market Expansion and Global Footprint Enhancement

Leading automotive axle manufacturers are expanding their operations through acquisitions to gain a stronghold in emerging markets.

- Companies are targeting regional axle manufacturers to increase production capacity and reduce logistical costs.

- Joint ventures with local automotive firms help global players navigate regulatory challenges and gain market access.

- Strategic acquisitions of OEM suppliers allow manufacturers to strengthen their position in the supply chain.

Supply Chain Optimization and Cost Efficiency

Rising raw material costs and supply chain disruptions are driving manufacturers toward vertical integration through mergers.

- Acquiring metal and component suppliers ensures a steady supply of raw materials, reducing dependency on third-party vendors.

- Mergers with logistics and distribution firms improve efficiency and reduce overall production costs.

- Partnerships with aftermarket service providers enhance the availability of replacement axle components, boosting aftermarket sales.

Notable Mergers, Acquisitions, and Collaborations in the Automotive Axle Industry

Dana Incorporated and Nordresa

Dana Incorporated acquired Nordresa, a Canada-based electric powertrain solutions provider, to enhance its expertise in e-axle systems. This acquisition has strengthened Dana’s position in the electric vehicle (EV) market, enabling it to supply integrated e-propulsion systems to automakers worldwide.

ZF Friedrichshafen and WABCO Merger

ZF Friedrichshafen’s acquisition of WABCO, a leader in braking and control systems, has allowed ZF to develop integrated axle and safety solutions for commercial vehicles. This move enhances the efficiency of heavy-duty trucks by combining advanced braking technology with next-generation axle systems.

Meritor’s Acquisition by Cummins

Cummins’ acquisition of Meritor was a significant move to expand its electrification capabilities. Meritor’s expertise in drivetrain and axle technologies, particularly in electric axle development, has helped Cummins strengthen its position in the zero-emission commercial vehicle market.

Hyundai’s Partnership with Aptiv for Autonomous Vehicle Development

Hyundai’s joint venture with Aptiv, a leader in autonomous driving technologies, aims to develop advanced mobility solutions, including AI-driven axle systems for self-driving vehicles. This collaboration highlights the increasing role of smart axle technologies in the future of autonomous transportation.

Challenges in Automotive Axle Mergers and Acquisitions

Regulatory Compliance and Antitrust Issues

Many high-profile mergers face strict government regulations, especially in cross-border deals. Compliance with different safety and environmental regulations across regions complicates integration processes.

Integration of Technologies and Operations

Merging companies often face challenges in aligning manufacturing processes, IT infrastructure, and workforce integration, leading to initial inefficiencies.

High Capital Investments

Acquisitions in the automotive sector require substantial investments, which may impact short-term profitability before yielding long-term benefits.

Future Outlook for Mergers and Collaborations in the Axle Market

- Increased Investments in EV Axles: More acquisitions will focus on electrification, with manufacturers acquiring startups specializing in e-axles and battery integration.

- Stronger Supply Chain Alliances: Partnerships with raw material suppliers and logistics firms will help companies mitigate supply chain risks.

- AI and Automation Expansion: Mergers with AI-driven mobility companies will accelerate the development of smart axle technologies for self-driving and connected vehicles.

Final Thoughts

Mergers, acquisitions, and strategic collaborations are playing a pivotal role in shaping the future of the automotive axle market. With the increasing demand for electrification, automation, and lightweight axle solutions, manufacturers are leveraging partnerships to stay ahead in the competitive landscape. By investing in technology-driven acquisitions and optimizing supply chains, companies can position themselves as industry leaders in the evolving automotive sector.