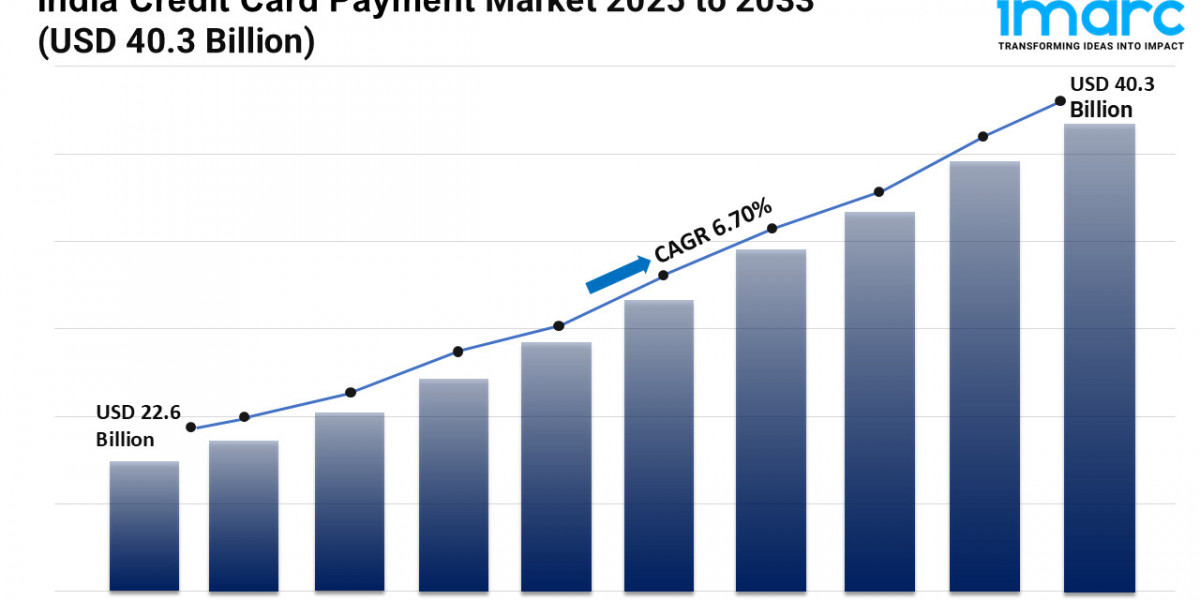

India Credit Card Payment Market Overview

Market Size in 2024: USD 22.6 Billion

Market Forecast in 2033: USD 40.3 Billion

Market Growth Rate: 6.70% (2025-2033)

According to the latest report by IMARC Group, the India credit card payment market size was valued at USD 22.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 40.3 Billion by 2033, exhibiting a CAGR of 6.70% from 2025-2033.

India Credit Card Payment Industry Trends and Drivers:

The India credit card payment market is on a growth trajectory due to many reasons for its emergence. Among the main factors is a fast track of the digital penetration, with consumers increasingly opting for digital financial solutions for their day-to-day transactions. Excelling in convenience and speed, digital payment systems have changed the way people interact with businesses: allowing swift purchases with maximum security and little or no physical cash involved. Furthermore, with an increasing number of different credit card products available for a wider variety of demographics, providers have been innovating continually in that area by introducing specialized cards for different consumer needs,-from travel rewards to cashback offers. This diversification is rendering credit cards more accessible and even attractive in all consumer adoption sectors.

Besides digital penetration, increasing consumer expenditure in major sectors like retail, travel, and entertainment are also contributing to market growth. As disposable incomes rise, there is an emerging trend of consumers opting for premium products and experiences, and consequently, credit cards have become an avenue to facilitate high-value purchases. The convenience of credit cards for both online and offline shopping encourages consumers to use them for everyday purchases, especially for large transactions. Attractive reward and loyalty programs have given added reasons for consumers to use credit cards. All these trends are contributing chiefly toward the growth of credit card schemes.

The constant evolution of payment security and convenience is yet another key force fueling the credit card payment market in India. Major credit card companies are broadening the scope of their offerings with enhanced security measures, including tokenization and biometric authentication, giving users increased confidence in their transaction process. Further, the emergence of contactless payments will pave the way for even smoother credit payments, enhancing speed and safety in transacting. These innovations support a seamless payment journey, appealing to tech-savvy consumers who prioritize convenience and security. Growing acceptance by consumers and merchants alike will ensure this market growth proceeds steadily, with a firm foundation in secure and user-friendly payment alternatives.

Download sample copy of the Report: https://www.imarcgroup.com/India-Credit-Card-Payment-Market/requestsample

India Credit Card Payment Industry Segmentation:

The report has segmented the market into the following categories:

Card Type Insights:

- General Purpose Credit Cards

- Specialty Credit Cards

- Others

Provider Insights:

- Visa

- Mastercard

- Others

Application Insights:

- Food and Groceries

- Health and Pharmacy

- Restaurants and Bars

- Consumer Electronics

- Media and Entertainment

- Travel and Tourism

- Others

Regional Insights:

- North India

- South India

- East India

- West India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

India Credit Card Payment Market News:

- In December 2024, Axis Bank partnered with Visa to introduce 'Primus' in India, an invite-only ultra-premium credit card for ultra-high-net-worth individuals. Providing unique privileges under Visa Infinite Privilege, Primus offers high-end luxuries such as private jets, personalized travel, fine dining experiences, and elite event access, rewriting premium banking experiences.

- In January 2024, India's Unified Payments Interface (UPI) rolled out UPI 3.0, taking digital transactions a notch higher through the integration of credit lines. The update will allow banks to provide pre-approved, short-duration, small-ticket loans through UPI, extending digital credit penetration. Top lenders, such as PNB, Axis Bank, SBI, and ICICI Bank have already conducted trials of this new feature.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=32526&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145