The API banking market has become a pivotal element in the ongoing digital transformation of the financial services industry. Through the seamless integration of banking services with third-party applications, APIs (Application Programming Interfaces) facilitate innovation, improve customer experiences, and drive new business models. A thorough market analysis reveals the key factors driving growth, the challenges faced by participants, and emerging trends that are shaping the future of API-driven banking.

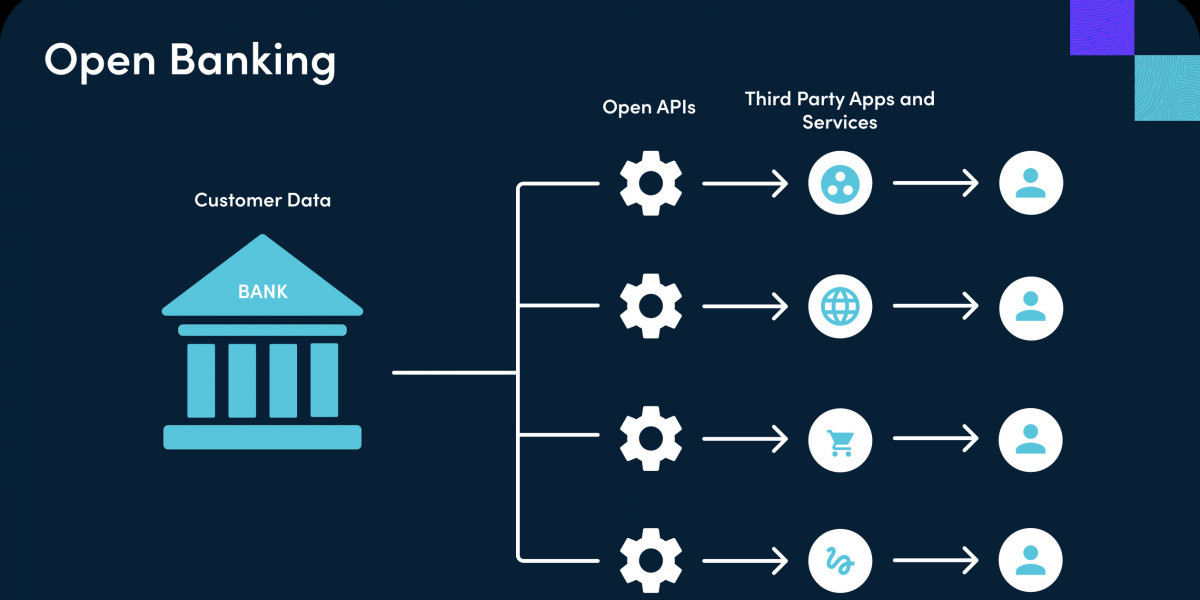

One of the primary growth drivers in the API banking market is the increasing adoption of open banking regulations globally. Governments and regulators are actively encouraging banks to share customer data securely with third-party developers via APIs. This openness fosters competition and innovation, enabling fintech companies to offer new financial products such as personalized lending, payment solutions, and wealth management tools. Regulations like Europe’s PSD2 have set a precedent, with many other regions following suit, creating a fertile environment for API banking growth.

Technological innovation is another critical factor accelerating market expansion. Advances in cloud computing, artificial intelligence (AI), and machine learning (ML) are enhancing the capabilities of APIs. Real-time data processing, predictive analytics, and intelligent automation enable banks to offer highly personalized services, improve fraud detection, and optimize risk management. The integration of these technologies with APIs is helping financial institutions move beyond traditional banking, providing customers with dynamic and responsive digital experiences.

The rise of Banking-as-a-Service (BaaS) platforms represents a significant market trend. These platforms allow non-bank entities, including retailers, fintech startups, and tech companies, to embed banking services directly into their offerings through APIs. This model broadens the reach of financial services, enabling new revenue streams and business models while expanding financial inclusion by reaching previously underserved populations.

Customer demand for seamless, instant, and personalized financial services is a powerful market force. APIs enable banks to connect multiple digital channels—mobile apps, online platforms, and third-party services—creating cohesive and frictionless customer journeys. The ability to aggregate data across platforms provides users with consolidated views of their finances, helping improve financial decision-making and engagement.

Despite these positive drivers, the API banking market faces several challenges. One major issue is security and privacy concerns. Opening access points via APIs introduces vulnerabilities that cybercriminals may exploit. Financial institutions must implement stringent security measures such as strong authentication, encryption, and continuous monitoring to safeguard sensitive data. Compliance with evolving data protection regulations further complicates this landscape, requiring ongoing investment and vigilance.

Integration with legacy banking systems remains a significant hurdle. Many banks operate on outdated core systems not originally designed to support API functionality. Retrofitting APIs onto these systems can be costly and technically complex, often resulting in performance issues and delayed service delivery. This integration challenge slows down innovation and limits the speed at which new API-driven services can be deployed.

The market also contends with the lack of universal standards for APIs. Various banks and fintechs create proprietary APIs with differing protocols, data formats, and security requirements. This fragmentation increases development complexity for third parties and hinders interoperability across the broader ecosystem. Industry-wide efforts to standardize API frameworks and promote open standards are ongoing but have yet to achieve full adoption.

From a competitive standpoint, the API banking market is witnessing increased collaboration and consolidation. Traditional banks partner with fintech firms and technology providers to leverage complementary strengths—combining regulatory experience and customer trust with agility and innovative capabilities. Meanwhile, some large technology companies are entering the financial space directly, using their API expertise to disrupt conventional banking models.

Geographically, the market analysis shows significant regional variation. Europe leads due to early regulatory frameworks and mature fintech ecosystems. The Asia-Pacific region is experiencing rapid growth fueled by digital adoption and government initiatives supporting fintech innovation. North America is evolving steadily, with increasing interest in API banking despite less regulatory pressure compared to Europe. Emerging markets present substantial opportunities, driven by mobile-first banking and unmet financial inclusion needs.

Looking ahead, several emerging trends will influence the API banking market’s trajectory. The integration of blockchain technology with APIs is gaining attention for enhancing transaction transparency and security. The expansion of embedded finance—where financial services are integrated into non-financial platforms—will continue to redefine customer engagement models. Additionally, increased use of data analytics and AI-powered insights will allow banks to proactively tailor services and anticipate customer needs.

Sustainability and ethical finance are becoming priorities, with APIs potentially playing a role in enabling transparent reporting and responsible investing tools. Furthermore, the ongoing development of cross-border API solutions will facilitate smoother international payments and multi-currency management, supporting the globalization of commerce and finance.

In conclusion, the API banking market analysis reveals a dynamic and rapidly evolving sector driven by regulatory support, technological innovation, and shifting customer expectations. While challenges such as security, legacy integration, and standardization persist, ongoing collaboration among banks, fintechs, and technology providers is fostering a vibrant ecosystem. The future of API banking lies in creating open, secure, and scalable platforms that empower customers and businesses alike, ultimately transforming how financial services are delivered and experienced worldwide.